Dying can be an expensive business. Many families are burdened by the final expenses for loved ones and sometimes they are stretched to make the final preparations.

But you can help your family by securing final expense insurance, which is designed to cover the bills that your loved ones will face after your death. Costs include medical bills and funeral expenses. That said, if you are considering this type of insurance, you have to make sure you get it right.

Here’s what you need to know.

What is it?

A final expense life insurance policy isn’t the same as other life insurance. Term and permanent life insurance value your policy as proportionate to your earning power now and for the rest of your life, and are meant to help your family make up for the loss of income that your passing may cause.

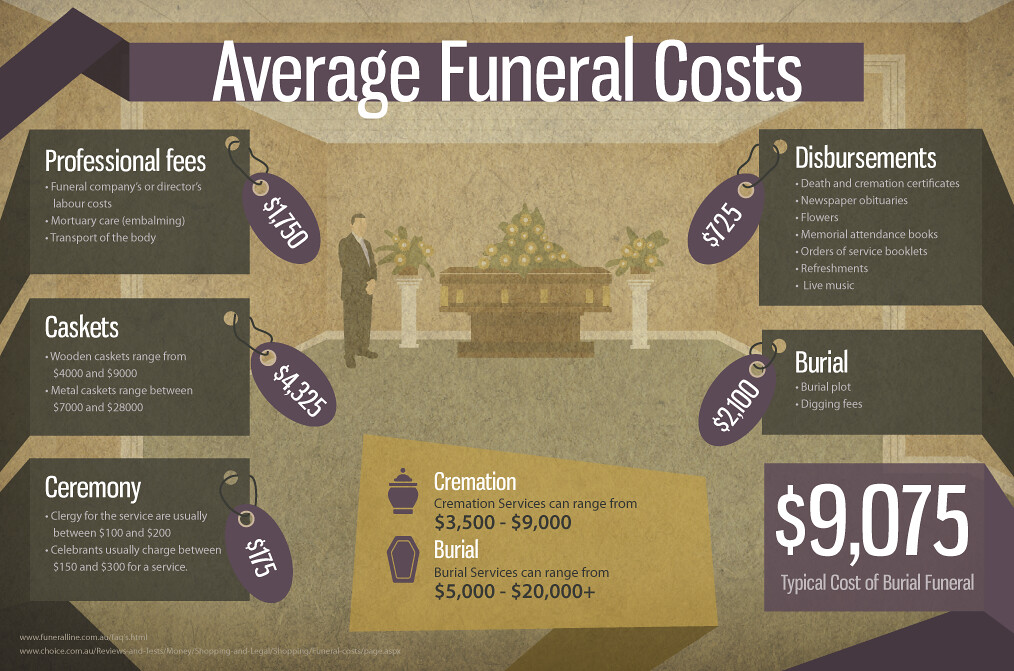

With final expense insurance, the value of your policy is proportionate to the expense of your desired funeral. While coverage in other forms of life insurance can exceed a million dollars, it’s rare for final expense insurance policies to pay out more than $20,000.